Crafting Your Wealth Formula

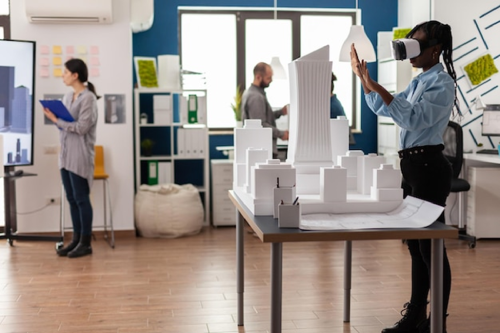

Step into Buyers Lab for an immersive experience where education meets inspiration!!

Educate and Empower:

Our Mission

The primary objective of Buyers Lab is to educate and motivate individuals to embark on the journey of property investment. We demystify the complexities, making wealth creation accessible to all. Through insightful guidance and comprehensive resources, we empower you to take charge of your financial future.

Unveiling the Science of Wealth Creation

At Buyers Lab, we believe in the precision of wealth creation—a science where every element is carefully chosen to construct the perfect formula for financial success. Just as a lab employs the right chemicals to create a desired reaction, we utilize the essential ingredients to build a foolproof wealth strategy.

The Six-Pack Strategy: Your Wealth Elixir

Our cornerstone philosophy revolves around the powerful six-pack strategy. Just as a skilled mixologist crafts a perfect cocktail, we curate a blend of the right properties at the right time and the right price. This strategy forms the backbone of your personalized wealth elixir.

1. Market Health Check:

- Conduct thorough research on real estate markets to identify areas with growth potential.

- Analyze historical trends and future projections to understand market dynamics.

- Assess factors such as job growth, infrastructure development, and local amenities.

2. Client’s Financial Health Check:

- Determine your financial goals and risk tolerance.

- Establish a budget and assess your financial eligibility for property investment.

- Consider factors like mortgage rates, loan options, and potential return on investment.

3. Area & Property Selection:

- Identify Area and properties that align with your investment goals.

- Consider factors such as location, property type, potential for appreciation, Cash Flows, Occupancy Rate etc..

- Evaluate the property’s condition, market demand, and potential rental income.

4. Timing the Market:

- Stay informed about market cycles and timing for optimal entry or exit.

- Be strategic about when to buy or sell based on market conditions.

- Consider economic indicators and real estate trends for well-timed decisions.

5. Risk Management:

- Evaluate and mitigate risks associated with property investment.

- Diversify your real estate portfolio to spread risk.

- Consider factors like property management, market volatility, and economic uncertainties.

6. Professional Guidance:

- Seek advice from real estate professionals, including real estate agents, financial advisors, and legal experts.

- Work with specialized buyers’ agents who understand your investment goals.

- Leverage the expertise of professionals to make informed decisions.

Each of these elements contributes to the overall success of a wealth creation strategy in real estate. The synergy of these components, when carefully considered and executed, can enhance the likelihood of creating sustainable wealth through property investment. It’s important to continuously reassess and adjust your strategy based on changing market conditions and personal financial objectives.